IBC's 2025 Q1 Economic Outlook Survey Released

IBC Projects Positive Six-Month Economic Outlook

Iowa companies resilient despite declines in all categories

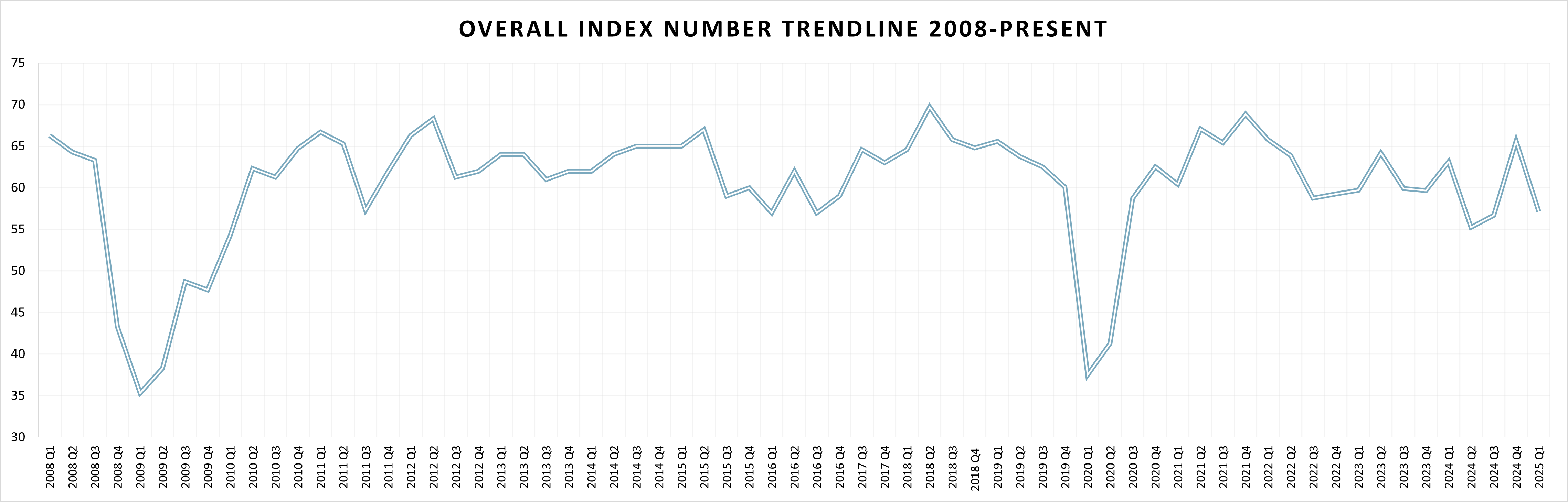

DES MOINES, IA – The Iowa Business Council (IBC) has released its first-quarter Economic Outlook Survey (EOS) for 2025. The report measures IBC member expectations for sales, capital spending and employment for the next six months. If the index measures above 50, sentiment is positive. The survey’s overall economic outlook index is 57.14, a decrease of 8.49 points from the previous quarter and 3.27 points below the historical average of 60.41 signifying a moderating approach over the next six months. Of note, the survey results were captured prior to the April 2, 2025, tariff announcements.

All three categories experienced declines compared to the 2024 fourth-quarter survey.

- Sales expectations declined 4.46 points to a value of 64.29

- Capital spending expectations declined 9.30 points to a value of 54.76

- Employment expectations declined 11.68 points to a value of 52.38

“Despite an increase in uncertainty and recent downward pressure on markets, all three IBC metrics remain in positive territory,” stated Gage Kent, CEO of KENT Corporation® and Chairman of the Iowa Business Council. “We look forward to continuing to work with policymakers in Iowa and in Washington, DC, to craft pro-growth business policies that expand opportunity across all sectors of Iowa’s economy.”

An unfavorable business climate (national supply chain, infrastructure, federal regulations) was listed as the top primary business challenge cited by 71% of those surveyed. Inflation and workforce attraction and retention were both citied by 43% of survey participants to round out the top three primary business challenges.

“While uncertainty at the federal level—particularly around tariff and tax policies—creates challenges, we continue to see opportunities for growth and innovation,” stated Joe Murphy, IBC President. “By staying proactive and adaptive, Iowa businesses can navigate these uncertainties and position themselves for long-term success.”

The Economic Outlook Survey has been completed by IBC members on a quarterly basis since 2004. The report provides insight regarding the projected trends for the state of Iowa, which can be used for business and economic planning. The reported trends have a state-wide impact, especially when considering that IBC companies have a presence in all 99 counties. To review previous Economic Outlook Surveys, please visit www.iowabusinesscouncil.org/news/eos.

* Q1 survey results were captured prior to the tariff announcement on April 2, 2025.

###

About the Iowa Business Council

The Iowa Business Council (IBC) is a nonpartisan, nonprofit organization whose 21 members are the chief decision makers of major Iowa employers. Employing over 150,000 Iowans, IBC member companies have invested billions of dollars of capital in Iowa's commercial infrastructure; lead the way in technology innovation, R&D, and grants procured; and are often the driving financial and volunteer forces behind philanthropic efforts all over the state.

IBC member companies include: Alliant Energy; Atlantic Coca-Cola Bottling Company; Casey’s General Stores, Inc.; Collins Aerospace; Corteva Agriscience; Deere & Company; Fareway; HNI Corporation; Hy-Vee, Inc., Iowa Bankers Association; Kent Corporation; MercyOne; MidAmerican Energy Company; Pella Corporation; Principal; Ruan Transportation Management Systems; The Weitz Company; UnityPoint Health; Vermeer Corporation; Wellmark Blue Cross Blue Shield of Iowa; and Workiva.